With Charlotte’s Internet ‘in jeopardy,’ owners require overhaul on top

TPCO, Gold Plants Obtain Investor Nod for Merging

June 17, 2023Alabama Officials Hold-up Medical Cannabis Company Licensing Over Inconsistencies In Application Rating

June 18, 2023Creators of leading united state CBD manufacturer Charlotte’s Internet have actually asked for modifications on top by looking for resignations from 4 of 6 existing supervisors, consisting of board Head of state John Held as well as the firm’s chief executive officer, Jacques Tortoroli.

In a pungent press declaration launched Monday, establishing siblings Joel as well as Jesse Stanley claimed tactical errors, unchecked investing as well as inadequate employing techniques have actually placed the Denver-based firm “in jeopardy.”

” The incumbent Board as well as monitoring’s company technique has actually been to pin their hopes on FDA policies altering for business,” the siblings claimed in the declaration “As opposed to introduce within the existing structure, the Business remains to melt cash on standard advertising and marketing.”

Ahead of the firm’s yearly basic conference set up for this Thursday, the Stanleys advised fellow investors to keep elect Held, Tortoroli as well as independent supervisors Thomas Lardieri as well as Alicia Morga. The Stanleys evidently have no beef with Susan Vogt as well as Jonathan Atwood, 2 various other supervisors that would probably advance the board.

‘ Expensive settlement’

The siblings slammed the firm’s management for altering the CFO 4 times in the previous 2 years, as well as for paying “excessively high settlement to the chief executive officer as well as various other elderly execs,” as well as claimed “monitoring has actually not been held responsible by the Board for going after purchases as well as representative as well as advertising and marketing connections yet consistently stopping working to effectively perform on these purchases.”

Joel Stanley claimed the 4 supervisors targeted for termination “will certainly stop working to accomplish bulk assistance,” as well as ought to “do the ideal point by tipping down as well as prevent postponing adjustment.” The Stanleys advised the 4 be changed on their own as well as Lynn Kehler, a company as well as financing exec, as well as all-natural items market expert Angela McElwee.

According to the Stanleys’ news release, Big league Baseball (MLB), a critical investor in Charlotte’s Internet, concurs that the modifications are required. The firm in 2015 struck a spots special advertising and marketing bargain that offered the organization 4% of the firm’s shares, as well as dedicated to pay MLB $30.5 million plus a 10% aristocracy for sale. Experts claimed as the bargain, which goes to 2025, will not imply substantial extra earnings for the firm.

Where’s all-time low?

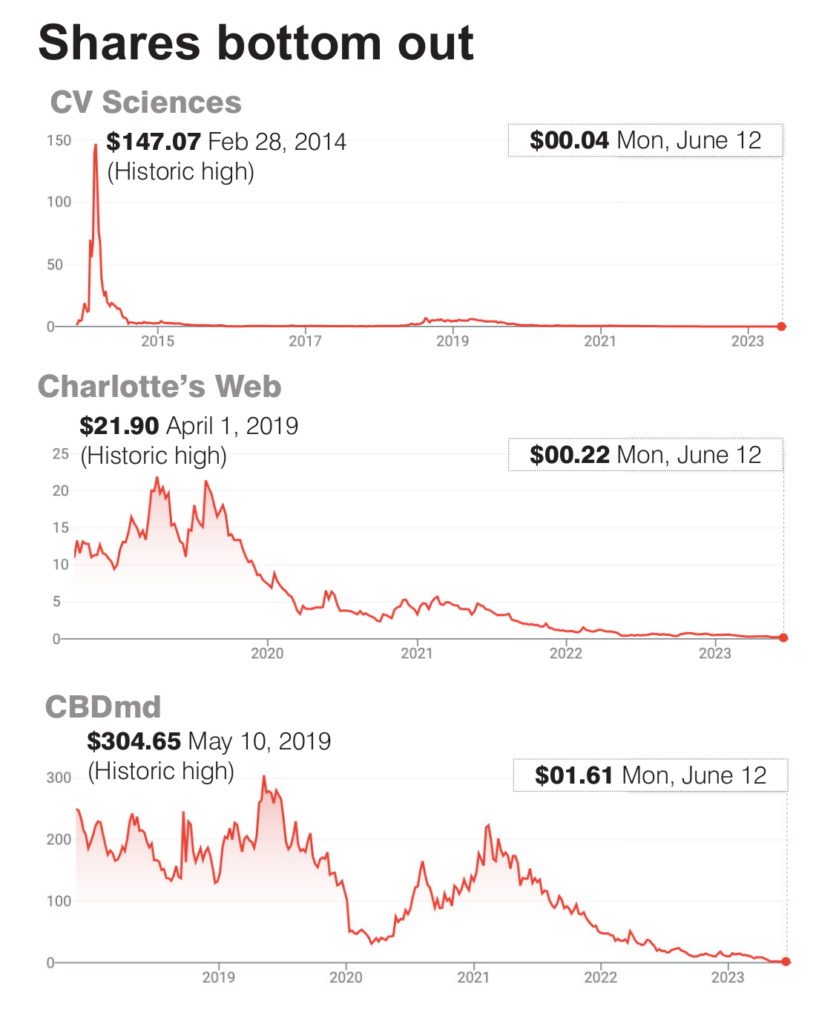

The suggested overhaul at Charlotte’s Internet comes as openly traded CBD firms proceed in the funks, with contracted margins, soft sales as well as regulative unpredictability driving the industry to the base, any place that might be.

Charlotte’s Internet shares shut Monday, June 12 at $0.2196 (concerning 22 cents) versus the supply’s all-time high of $21.90 gotten to April 1, 2019. The firm went public in September 2018 on the Toronto Stock Market as well as the OTCQX Endeavor Market in the united state– dangerous “dime supply” or “tiny cap” markets that are extremely unstable.

Charlotte’s Internet had a bottom line of $59.3 million on earnings of $74.1 million in 2015, according to its year-end monetary declaration

Burning cash money

The Stanleys state losses have actually amounted to $186 million in the 24 months finishing March 31, 2023 as the firm experienced “a stable decrease in earnings throughout all networks, with little to no item technology or SKU growth.”

” The substantial cash money melt price with reducing earnings have to finish promptly,” claimed Jesse Stanley.

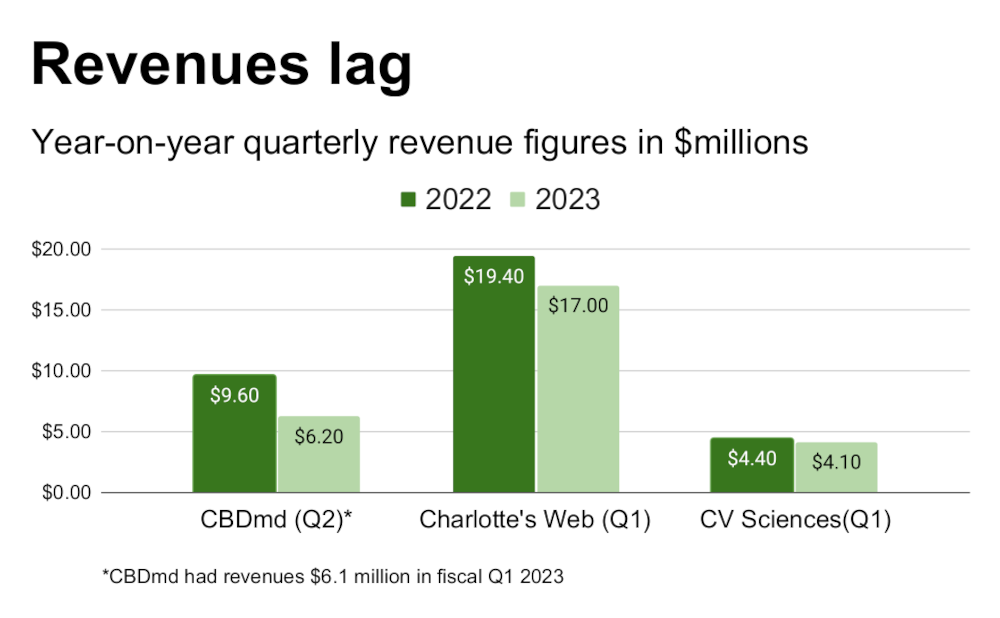

In its Q1 2023 Record, Charlotte’s Internet condemned its descending slide on reducing need for CBD cast in the business-to-business as well as direct-to-consumer markets as clients count on lower-priced gummies as well as topical items, as well as concentrated on its development in cost-cutting. “We preserved sensible price controls to stabilize soft qualities in the CBD classification,” the firm claimed, noting it lowered general expenses by 14% on a year-on-year basis, from $20.4 million in Q1 2022 to $17.5 million in Q1 2023.

Prevalent suffering

A HempToday testimonial of quarterly records revealed that Charlotte’s Internet, CBDmd as well as Curriculum Vitae Sciences– every one of which generate CBD items specifically– documented consolidated quarterly losses of about $7 million at the start of 2023. That was a general enhancement contrasted to consolidated losses of $15 million in analog quarters for 2022, yet the gains have actually come purely from cutting expenses.

All 3 additionally experienced earnings decreases contrasted to earnings in the very same quarter in 2015.

On the other hand share costs of the firms stay unstable, with a lot of the supplies substantially below historical highs.

CBDmd’s share triage

Charlotte, North Carolina-based CBDmd claimed it accomplished cost savings of $24 million in running expenses year-on-year year in monetary Q2 2023 The firm’s battles were highlighted in April when the CBDmd board of supervisors authorized a one-for-45 reverse supply split, efficiently reducing the worth of its shares by about 98% while combining its 65.5 million shares to roughly 1.45 million. CBDmd’s bottom lines in 2022 were $70 million versus earnings of $35 million.

curriculum vitae Sciences reported devices offered throughout the quarter were down 13%, as well as claimed it has a “strategy to proceed joining the loan consolidation as well as brand name tightening of the CBD market.” The San Diego-based firm claimed its first-quarter gross margins went beyond assumptions which it is “urged by renovations we have actually made to lower running cost.” Bottom lines for curriculum vitae Sciences in 2022 amounted to $8.2 million as the firm generated earnings of $16.2 million.

In a Might 15 regulative declaring with the Stocks as well as Exchange Payment, curriculum vitae Sciences specified: “As a result of a reduced obstacle access market with an absence of a clear regulative structure, we encounter extreme competitors from both accredited as well as illegal market drivers that might additionally offer plant-based nutritional supplements as well as hemp-based CBD customer items.”

Cronos leaves united state

Additionally suggesting battles for CBD in the United State, Toronto-based Cronos Team, which remains in both the cannabis as well as CBD company, reported losses of $19.3 million in Q1 2023, as well as the firm introduced recently its intents to take out from the American CBD market. The Q1 2023 losses followed Cronos took a $168.7 million struck throughout its last complete .

In introducing its separation from the united state, Cronos is basically surrendering on a $300 million financial investment it made in 2019 when it purchased 4 CBD subsidiaries of Redwood Holding Team. The firm has actually currently pulled back to the Canadian CBD market, where its CBD company creates just around $1 million in earnings, much less than one percent of the firm’s overall earnings, which is extremely from cannabis. Cronos currently claims it is “laser-focused on coming to be cash-flow favorable by driving price financial savings as well as procedure performances” as it focuses on its cannabis items.

Cronos claimed the closure of its CBD procedures in the united state will certainly lead to fees of as much as $1.8 million in the existing quarter. The firm additionally claimed it enhanced its 2023 cost-cutting objective to $20-$ 25 million, up from $10 million to $20 million formerly prepared for the existing year.

Existential concerns

Along with damaged need as well as the large excess of hemp blossoms required to generate CBD, which brought costs diving to planet start in 2019, the industry encounters significant various other difficulties.

CBD manufacturers have actually grumbled for 5 years that an absence of policies is holding the market back. While policies might be coming, it does not show up that will certainly be anytime quickly. When they do come, CBD stakeholders might obtain greater than they yearn for, as the united state Food & & Medicine Management (FDA) has actually offered signals that it can appoint CBD to a medication classification, which would certainly erase the marketplace as it currently exists.

Driven by a safety-first values, FDA has actually consistently shared problems concerning CBD’s possible results on the liver as well as male reproductive system, fears over negative communications with specific drugs, as well as is afraid over direct exposure to children, expectant ladies as well as unborn children, as well as the senior. The FDA in late April launched a “Testimonial of the dental poisoning of cannabidiol (CBD),” a threatening 40-page paper based upon a collection of existing medical research studies, highlighting those safety and security problems.